Author: Leigh Jobling, Partner, TAG Financial Services

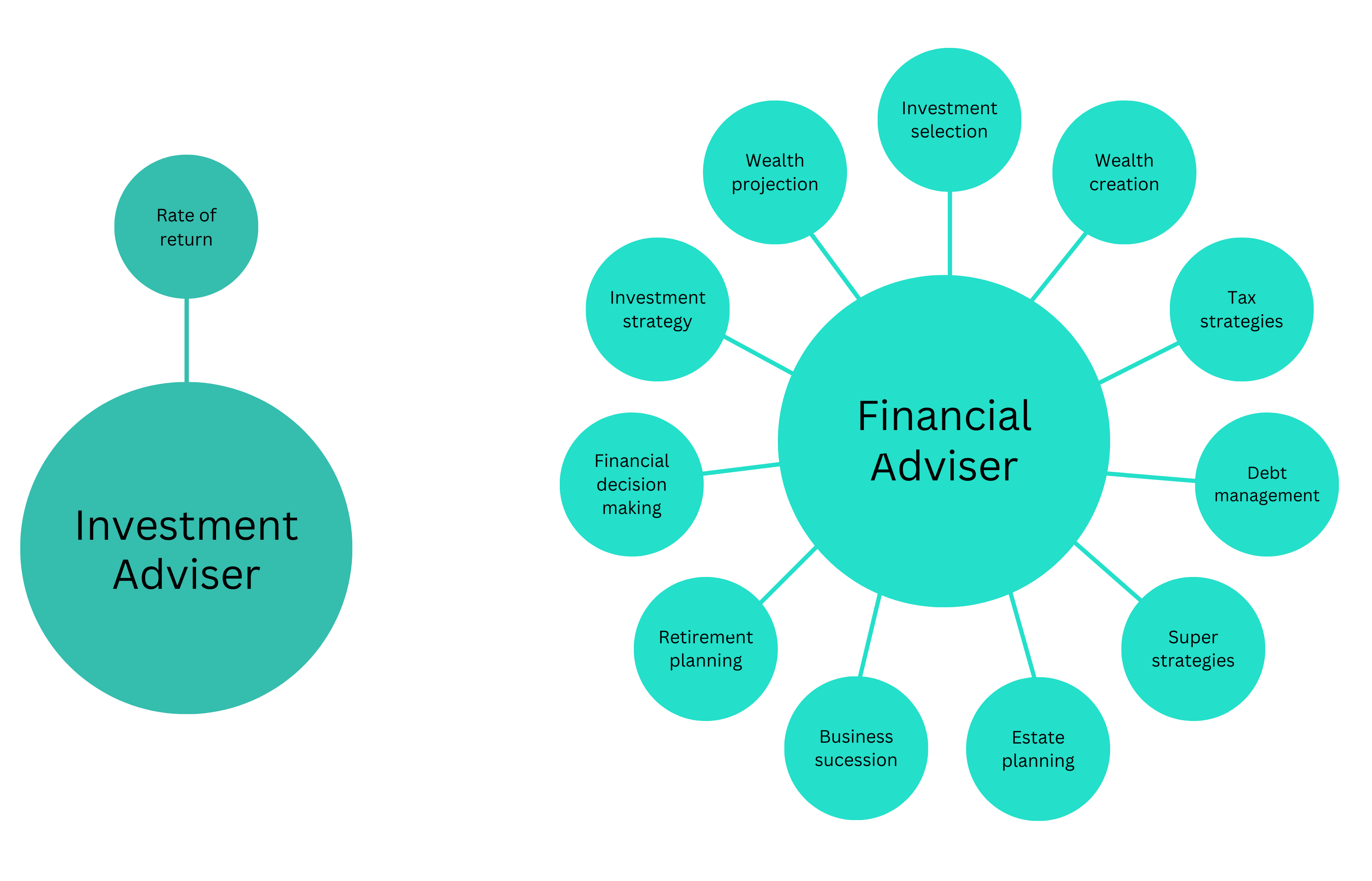

The focus of Investment Advisors is getting a rate of return.

The focus of Financial Advisers is to make a meaningful difference to the financial lives of their clients, helping them live their best life, achieving and doing things that are important to them, with less financial stress and more confidence and peace of mind.

At TAG, when we think of financial advice and the difference we make to the lives and financial futures of our clients, we think of and engage clients around:

- Cash flows and wealth creation strategies

- Tax management, including structuring asset holdings

- Debt management

- Superannuation and Retirement planning

- Wealth protection and the role of life and disability insurances

- Estate Planning and business succession

- Investment strategy and selection

- Assisting them to navigate difficult decisions and avoid making costly mistakes

In developing a financial strategy unique to each client, we understand their financial concerns, plans for the future and living their “ideal life”, assisting the next generation/s and ensuring they can retire on their terms, without worrying about income or running out of money. Naturally when planning over the long term, the more time we have to implement strategy and allow the strategy to add value, the better. Naturally, the needs and priorities of clients change over time and their strategy must be dynamic and flexible to cater for those changes.

Helping clients achieve a sense of financial freedom, with less financial worry, where working less or stopping work all together is a possibility is something we are proud of. Helping clients realise they only work because they want to, not because they have to, is liberating and opens up opportunities to enjoy life with no regrets. Thinking less about the pay cheque and more about a rewarding life and a meaningful legacy for their family is what financial planning is all about.

Investing and generating a good rate of return is important but only a part of the overall process. Investing with wrong structures, creating poor tax outcomes, investing in the wrong things that compromise cash flow and lifestyle or limit flexibility and access to money and create complexity for your estate should be avoided.

Do you have a financial adviser who has developed a comprehensive financial strategy for you and your family?

Or do you have a stockbroker, estate agent, industry super fund or other investment based adviser who does not take the time to understand your “bigger picture” and what’s important to you and your family.

We encourage you to think about your adviser and what they do for you. If the only measure of their worth is rate of return, you don’t have a Financial Adviser.

More information

If you want to chat about financial planning or investments, feel free to get in touch with us on 03 9886 0800 or drop us an email. We’re here to help you make the most of your financial future.

What should you do now?

Become Money Smart

Build your financial knowledge and join our online community where you will receive TAG updates and invites to our Information Sessions.

Meet with us

If you would like to discuss your financial goals further, contact us to arrange a time.

Disclaimer: The information contained is general in nature. Professional advice should be sought before acting on any aspect on this page. Financial planning services provided by TAG Financial Advisors Pty Ltd (ABN 77 154 205 017 AFSL 415632), a wholly owned subsidiary of TAG Financial Services Pty Ltd (ABN 67 075 374 686). Copyright 2023. Please do not reproduce without the expressed written consent of the author.