Author: Arden Shaw, Manager, Investment Advisory & Wealth

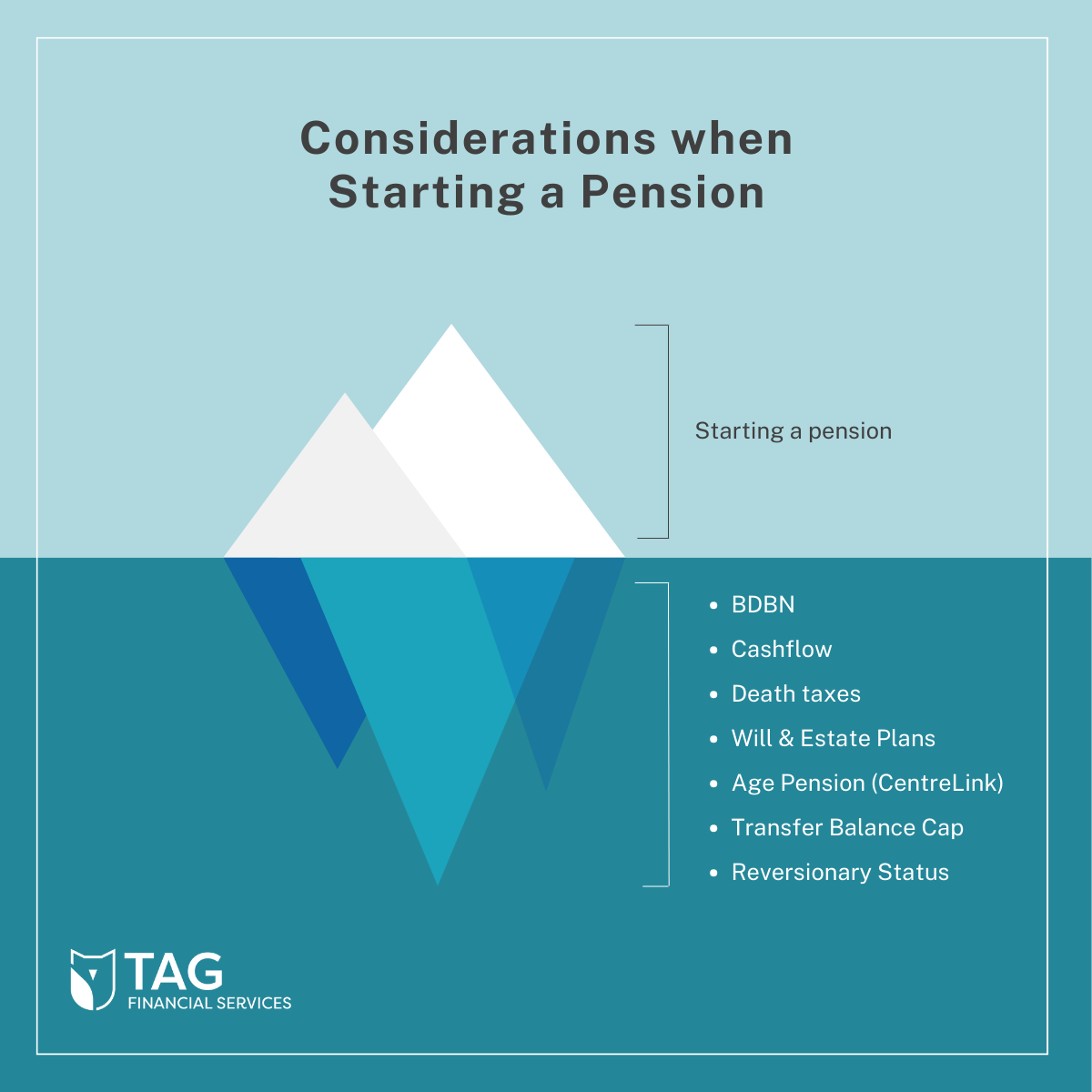

Your client has worked hard to build up their superannuation, and now it’s time to transition to a pension. Yet, beneath the surface lies a wealth of financial considerations crucial for shaping your future stability. It’s akin to an iceberg, with the pension representing merely the visible tip, while a myriad of vital considerations remain hidden below.

Here’s why it pays for your client to get some advice:

Cashflow

It’s important that they understand their cashflow, including:

- How much pension they will receive each year (there are minimum and maximum levels set by law).

- Other benefits they may be entitled to.

- How long their money will last.

Age Pension (Centrelink)

Accessing the benefits they are entitled to can help with achieving a financially secure retirement. The kind of government age pension and benefits generally depends on your age, assets and income.

Tax Considerations

Whilst the income from a client’s superannuation pension is generally free, if they are over the age of 60, there are still instances where this may not be the case. They may also have other income in their retirement that may be more effective if it is inside super.

Transfer Balance Cap

A client’s transfer balance cap is a lifetime limit on the amount they can transfer into one or more “retirement phase accounts” (in pension mode). The earnings within the super fund allocated to this account are tax free, which can be a significant advantage of starting the right sort of pension.

Death taxes

A client should understand the implications of the rules around what gets taxed and what doesn’t get taxed from their estate, or when it goes down to their adult children.

BDBN

A binding death benefit nomination (BDBN) is a legal document that directs how a client’s superannuation will be distributed upon their death. It can provide clarity and certainty in terms of the distribution of their super. However, not all nominations may be valid and binding, so getting advice and guidance on this is crucial.

Reversionary Status

A reversionary pension can ensure that a client’s chosen beneficiary continues to receive their pension when they pass away. It can be a valuable estate planning tool to ensure that on a client’s death their super savings go to the person they want with minimum fuss. But not everyone is eligible, so advice is needed to ensure the client’s wishes are kept in mind and documented appropriately, to ensure these mechanisms are used appropriately.

Will & Estate Plans

This is more than simply making a will. To be in control of their estate, a client should know:

- The role of Wills and Trusts in passing on their financial legacy to their loved ones.

- How to keep their inheritance in the family if one of their children’s marriage breaks down.

- Discover how Superannuation moves to the next generation.

- How good estate planning can minimise Death Taxes.

More information

If you have any questions about starting a pension, feel free to get in touch with us on 03 9886 0800 or drop us an email.

Specialist Advice

If you would like to discuss a project, please contact us. Our advice is quoted upfront for your approval before commencement.

![]() Webinars On Demand

Webinars On Demand

We have lots of informative webinars by our financial experts. Watch them any time on demand.

Disclaimer: The information contained is general in nature. Professional advice should be sought before acting on any aspect on this page. Financial planning services provided by TAG Financial Advisors Pty Ltd (ABN 77 154 205 017 AFSL 415632), a wholly owned subsidiary of TAG Financial Services Pty Ltd (ABN 67 075 374 686). Copyright 2024. Please do not reproduce without the expressed written consent of the author.