Author: Leigh Jobling. Partner, TAG Financial Services

In 2023, overseas share markets performed wonderfully well. The US stock markets (which represents around 50% of all developed markets) returned around 24%.

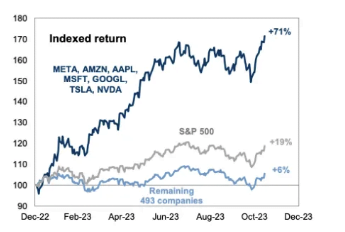

In the chart below, the grey line shows a 19% return for the calendar year to October 2023. The S & P 500 is the measure of the value and performance of the largest 500 US listed companies. You can see that 7 stocks rose by a collective 71%, while the light blue line shows the performance of the other 493 companies in the index.

Image source: www.finance.yahoo.com

One chart shows how the ‘Magnificent 7’ have dominated the stock market in 2023 (yahoo.com)

The Magnificent 7

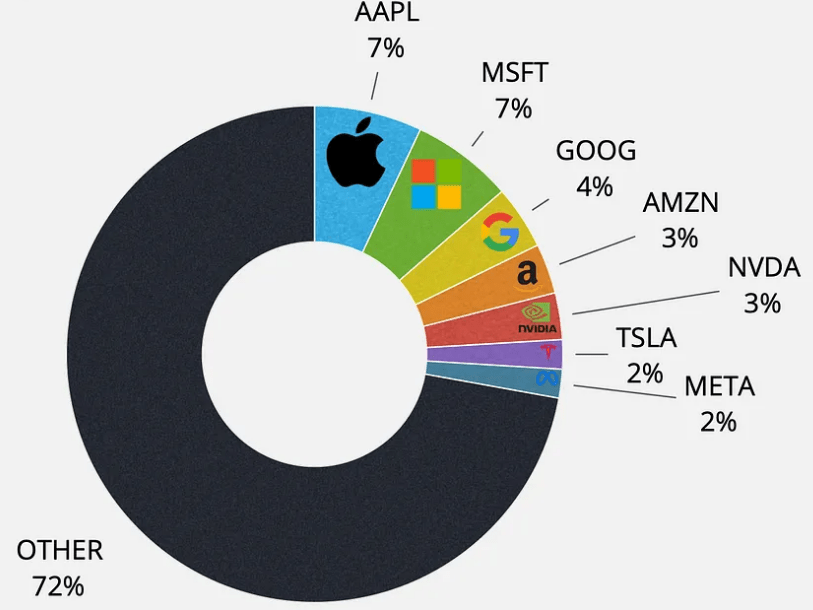

These 7 stocks are all technology companies and are often referred to as the Magnificent 7. The companies are Apple, Amazon, Google, Meta (formerly Facebook), Microsoft, Nvidia and Tesla.

Image source: www.masters.trade

The “Magnificent Seven” of the US stock market (masters.trade)

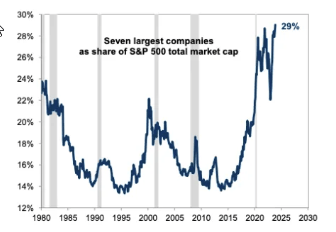

You may not realise it, but these 7 companies represent nearly 29% of the S & P 500 Index. The other 493 companies make up the other 71%.

Image source: www.finance.yahoo.com

One chart shows how the ‘Magnificent 7’ have dominated the stock market in 2023 (yahoo.com)

While technology is moving at a rapid rate, most notably the rise of Artificial Intelligence (AI) in the last few years, it feels like we are currently experiencing another tech bubble.

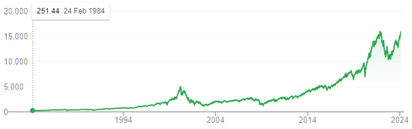

Lessons from the “dot.com bubble” and 2001 market crash

The chart below shows the NASDAQ index which is the measure of the value and performance of companies involved in technology industries.

The crash in 2001 was shocking, but the index is now over 3x higher than it was then, so any major tech correction would have a dramatic impact on the performance of the US market.

Conversely if the tech industry continues to outperform traditional industries such as banking and finance, retail, manufacturing, etc, the US is likely to be a standout performer over the course of 2024.

Balancing Caution with Opportunity

We highlight both the need to be cautious and the opportunity.

Caution:

Investing in the US S & P 500 Index has you well diversified across many companies. When investing in one sector, the diversification is diluted and returns overly dependent on the performance of just a handful of companies. Underperformance of some or all these companies could lead to particularly poor returns.

Opportunity:

With advancements in technology the S & P 500 provides wonderful exposure to the tech industry. The key will be the rate and extent to which companies can convert their product development into profits, because tech companies are valued based on the market’s expectation they will make bigger profits in the future – much bigger than they currently do. The share prices of these 7 companies are 2.5 times higher than more traditional industries based on future profit expectations.

If these profits do not materialise, we could be heading for another “tech wreck” like 2001/02.

Nevertheless, many believe that these companies will continue to outperform over the longer term, continuing the new tech era which appears well under way.

More information

If you would like to discuss this topic further, feel free to get in touch with us on 03 9886 0800 or drop us an email. We’re here to help you make the most of your financial future.

What should you do now?

Become Money Smart

Build your financial knowledge and join our online community where you will receive TAG updates and invites to our Information Sessions.

Meet with us

If you would like to discuss your financial goals further, contact us to arrange a time.

Disclaimer: The information contained is general in nature. Professional advice should be sought before acting on any aspect on this page. Financial planning services provided by TAG Financial Advisors Pty Ltd (ABN 77 154 205 017 AFSL 415632), a wholly owned subsidiary of TAG Financial Services Pty Ltd (ABN 67 075 374 686). Copyright 2024. Please do not reproduce without the expressed written consent of the author.