“Refinancing activity has remained at record highs in recent months, as borrowers continued to switch lenders amid interest rate rises,” according to the Australian Bureau of Statistics (ABS).

Owner-occupiers and investors refinanced a combined $20.2 billion of loans with external lenders in June, the ABS reported.

While that was 3.1% lower than the month before, it was 12.6% higher than the year before.

More significantly, the last 14 months have been the 14 biggest months in refinancing history.

Unfortunately, interest rate rises are affecting a lot of households at the moment. That’s why refinancing can be such a smart strategy. We can take a look at your existing loan and situation, compare the market and present some options to save you money.

Cash rate remains at 4.10%

The Reserve Bank of Australia (RBA) announced the cash rate will remain unchanged at 4.10% after its monetary policy meeting today.

This marks the third consecutive meeting at which the cash rate has been held.

The decision was in line with expectations, as it comes shortly after the Australian Bureau of Statistics released data showing annual inflation slowed to 4.9% in July from 5.4% in June.

While this suggests higher interest rates are having the desired impact on inflation, RBA governor Philip Lowe, once again, reiterated the central bank’s commitment to return inflation to its target range of between 2-3%.

As such, he did not rule out more interest rate rises in the coming months.

With so much uncertainty about interest rates, it can help to talk to an industry specialist. Contact us if you’d like to discuss your situation and options.

Lenders have not passed on all of the RBA’s rate hikes

Despite the interest rate rises that have occurred since last year, rates are lower than one would expect due to “strong competition between lenders”, according to the Reserve Bank.

Between May 2022 and June 2023, the cash rate increased by 4.00 percentage points. But during that same period, the average interest rate for outstanding variable-rate loans increased by only 3.37 percentage points.

When all outstanding loans (variable and fixed) are taken into account, the average interest rate increased by 2.75 percentage points during the same period. That’s because some borrowers still have low-rate fixed loans that were issued before the rate hikes began.

“The share of borrowers rolling off fixed-rate mortgages – taken out two to three years ago at low interest rates – onto much higher rates peaked at just under 5.5% of outstanding housing credit in the June quarter; it will stay high for the rest of this year, before declining in 2024,” the Reserve Bank said.

“These expiries will see the average outstanding mortgage rate continue to increase as the effect of the rise in the cash rate since May 2022 flows through to a greater share of borrowers.”

“No solution on the horizon” for tight rental market

Property investors in much of Australia are enjoying very low vacancy rates – and one leading property researcher has forecast that is unlikely to change anytime soon.

The national vacancy rate in July was just 1.3%, according to SQM Research, which means there are very few untenanted rental properties right now. That makes it relatively easy for investors to find tenants and means renters will often accept higher rents to secure accommodation.

“Clearly, acute rental shortages remain with us. And besides more people grouping together to share the burden, there is no significant solution on the horizon,” SQM managing director Louis Christopher said.

Christopher added that the main cause of the tight rental market and fast-rising rents had been strong population growth. “Australia currently has, by far, the fastest growing population for any OECD country and clearly the rampant increases are currently breaching the country’s capacity to house all our people.”

Albanese govt sets ambitious homebuilding target

The federal government has increased its housing construction target, in a bid to increase supply and improve affordability.

Prime Minister Anthony Albanese, after meeting with the National Cabinet recently, announced a new national target to build 1.2 million well‑located new homes over five years, from 1 July 2024. That replaces the original target of 1 million homes, which was announced last year.

Only 10,000 of those homes will be built by the federal government. The vast majority will be built by the private sector. Some will be built by the states and territories. As a result, the government also announced $3 billion of performance‑based funding for states and territories that achieve more than their targets and conduct reforms to boost housing supply.

The government also announced an additional $500 million competitive funding program for local and state governments to kickstart housing supply.

An increase in the housing supply should lead to a decrease in demand, which should put downward pressure on property prices and make housing more affordable.

If you are buying, re-financing or have any questions, contact me on the below information.

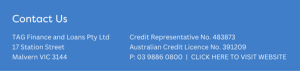

TAG Finance and Loans

TAG Finance and Loans

Sal Cinque | CEO

03 9886 0800 | loans@tagfinancial.com.au

Disclaimer: The information contained on this page is general in nature. Professional advice should be sought before acting on any aspect on this page. TAG Finance and Loans Pty Ltd ABN 25 609 906 863 Credit Representative Number 483873 National Mortgage Brokers Pty Ltd ABN 88 093 874 376 Australian Credit License 391209.